Below are the details regarding the certificate programs organized within the scope of the HOPINEU project.

Conflict of Jurisdictions, Conflict of Laws and Insurance Contracts

Insurance Contracts and Private International Law: A Comparison Between Turkish and EU Law

The objective of this seminar was to analyze the interactions between Insurance Law and Private International Law (PIL) with a comparative perspective between Turkish and the EU laws. Insurance contracts create a legal relationship between the insurance company on the one side and the policyholder, the insured and the third-party beneficiary on the other. It is presumed that these parties are, particularly when they are qualified as consumers, in an economically weaker position and they are less experienced in legal matters than the insurer. In the objective of protecting these parties, national laws contain some mandatory rules to limit the freedom of contract and provide the supervision of a public authority. This need for protection is also present in the context of the PIL when the insurance contract or the dispute arising in relation to it contains a foreign element at conflict of laws and conflict of jurisdictions levels. In this respect, a comparative study of the Turkish PIL and the EU PIL is useful to note the differences between these two regimes and potential areas where there is a need for harmonization.

The objective of this seminar was to analyze the interactions between Insurance Law and Private International Law (PIL) with a comparative perspective between Turkish and the EU laws. Insurance contracts create a legal relationship between the insurance company on the one side and the policyholder, the insured and the third-party beneficiary on the other. It is presumed that these parties are, particularly when they are qualified as consumers, in an economically weaker position and they are less experienced in legal matters than the insurer. In the objective of protecting these parties, national laws contain some mandatory rules to limit the freedom of contract and provide the supervision of a public authority. This need for protection is also present in the context of the PIL when the insurance contract or the dispute arising in relation to it contains a foreign element at conflict of laws and conflict of jurisdictions levels. In this respect, a comparative study of the Turkish PIL and the EU PIL is useful to note the differences between these two regimes and potential areas where there is a need for harmonization.

Principles of European Contract Law (PECL): A Comparison with the Turkish Code of Obligations

The certificate program of four hours was delivered in December 2019, in the framework of the Harmonisation of Principles of Insurance Law in Europe under the Erasmus+Jean Monnet Module, coordinated by Dr. Ayşegül Buğra. The program had the purpose of presenting to the students the provisions of Principles of European Contract Law (PECL) as an instrument of harmonization of general contract law, in comparison with the corresponding provisions of Turkish Code of Obligations. To this effect, the function and applicability of PECL as well as the content of some of its provisions were presented and students were provided with a critical approach to these provisions in light of the above mentioned comparations.

The certificate program of four hours was delivered in December 2019, in the framework of the Harmonisation of Principles of Insurance Law in Europe under the Erasmus+Jean Monnet Module, coordinated by Dr. Ayşegül Buğra. The program had the purpose of presenting to the students the provisions of Principles of European Contract Law (PECL) as an instrument of harmonization of general contract law, in comparison with the corresponding provisions of Turkish Code of Obligations. To this effect, the function and applicability of PECL as well as the content of some of its provisions were presented and students were provided with a critical approach to these provisions in light of the above mentioned comparations.

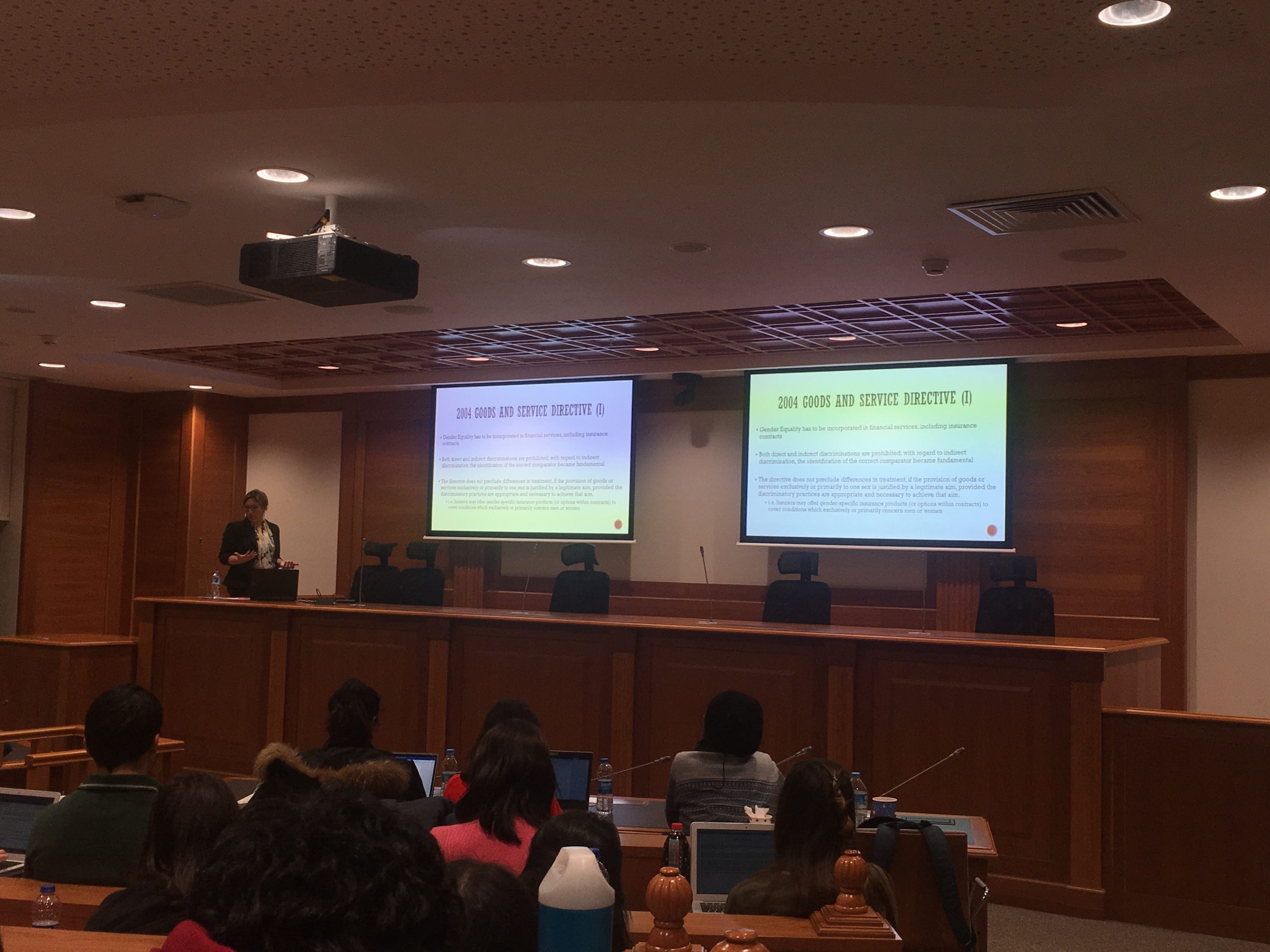

Differential Treatment in Insurance Based on Gender and Age

The Certificate Programme “Differential Treatment in Insurance Based on Gender and Age” has been held on 22 November 2019 in the framework of the Jean Monnet Module HOPINEU supported by the Erasmus+ Programme of the European Union. The Certificate Programme aimed at familiarizing students with the anti-discrimination principle into force in the European Union, notably focusing on how the principle has impinged in the insurance sector with specific regard to the prohibition of gender-based and age-based discrimination. In this vein, after an introduction on the principle of equality, the EU Treaties as well as the relevant Directives and the CJEU case-law have been analyzed.

Utmost Good Faith and Reinsurance Contracts

This certificate program was delivered by Prof. Robert Merkin QC (Honorary Queen’s Counsel / Lloyd’s Professor of Commercial at University of Exeter) as part of the certificate program series of the Jean Monnet Module project “Harmonisation of the Principles of Insurance Law in Europe (HOPINEU)” that is currently being run at Koç University Law School. It explored the application of the principle of utmost good faith in the context of reinsurance contracts. The event was well attended by bachelor and graduate students.

This certificate program was delivered by Prof. Robert Merkin QC (Honorary Queen’s Counsel / Lloyd’s Professor of Commercial at University of Exeter) as part of the certificate program series of the Jean Monnet Module project “Harmonisation of the Principles of Insurance Law in Europe (HOPINEU)” that is currently being run at Koç University Law School. It explored the application of the principle of utmost good faith in the context of reinsurance contracts. The event was well attended by bachelor and graduate students.

Principles of European Contract Law (PECL) as a Proposed Regime of Harmonized Contract Law

The certificate program of four hours was delivered in December 2018, in the framework of Erasmus+Jean Monnet Module grant project, coordinated by Dr. Ayşegül Buğra. The program had the purpose of presenting to the students the aim and instruments of harmonization of private law, with special focus on the provisions of PECL, applicable to insurance contracts in the absence of a specific provision in the Principles of European Insurance Contract Law (PEICL).

The certificate program of four hours was delivered in December 2018, in the framework of Erasmus+Jean Monnet Module grant project, coordinated by Dr. Ayşegül Buğra. The program had the purpose of presenting to the students the aim and instruments of harmonization of private law, with special focus on the provisions of PECL, applicable to insurance contracts in the absence of a specific provision in the Principles of European Insurance Contract Law (PEICL).

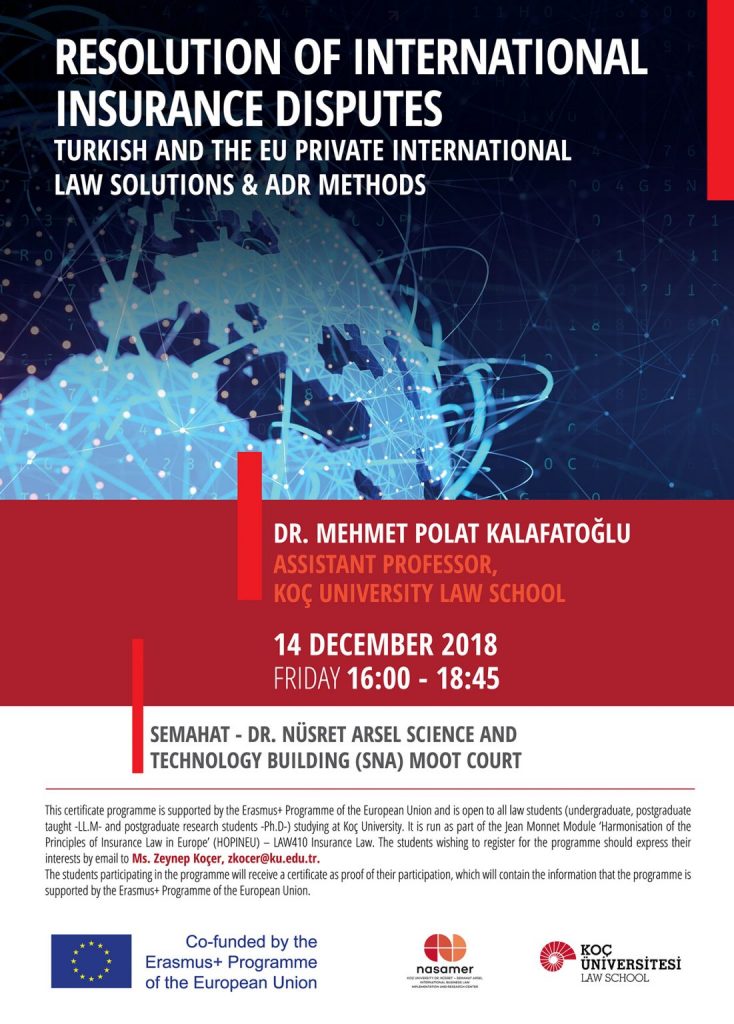

Resolution of International Insurance Disputes Turkish and the EU Private International Law Solutions & ADR Methods

The certificate program on insurance law had the objective of studying resolution of insurance disputes with international character. In this respect, it provided a general overview of the characteristics of cross-border insurance contracts and the type of disputes. The program aimed to answer three basic questions: the international jurisdiction of national courts, the applicable law to insurance contracts, and finally, the use of alternative dispute resolution methods (ADR) for cross-border insurance disputes. Considering the fact that this certificate program has been organized under the HOPINEU project, a special emphasis has been given to the comparison of the Turkish Private International Law Code and the EU Law provisions. It also enabled the students to identify problematic areas where a harmonization is needed between Turkish and the EU Law.

The certificate program on insurance law had the objective of studying resolution of insurance disputes with international character. In this respect, it provided a general overview of the characteristics of cross-border insurance contracts and the type of disputes. The program aimed to answer three basic questions: the international jurisdiction of national courts, the applicable law to insurance contracts, and finally, the use of alternative dispute resolution methods (ADR) for cross-border insurance disputes. Considering the fact that this certificate program has been organized under the HOPINEU project, a special emphasis has been given to the comparison of the Turkish Private International Law Code and the EU Law provisions. It also enabled the students to identify problematic areas where a harmonization is needed between Turkish and the EU Law.

Insurance Discrimination in Europe: The Relevance of Gender and Race

Dr. Scotti delivered a three hour certificate program to undergraduate and postgraduate students on risk profiling on the basis of gender and race and whether this would constitute discrimination according to recent case law from the Court of Justice of the European Union. The certificate program introduced the concepts of formal and substantive equality for understanding the content of possible discriminations and the rationale for the rules allowing fair discriminations among insureds. Framing the definition of such a fairness in a comparative perspective notably focusing on the comparison of the principles applicable in Europe and Türkiye, the seminar was devoted to the analysis of the anti-discriminatory provisions entrenched in the Principles of European Insurance Contract Law (PEICL), reiterating the European anti-discriminatory law on gender, nationality or race.

Dr. Scotti delivered a three hour certificate program to undergraduate and postgraduate students on risk profiling on the basis of gender and race and whether this would constitute discrimination according to recent case law from the Court of Justice of the European Union. The certificate program introduced the concepts of formal and substantive equality for understanding the content of possible discriminations and the rationale for the rules allowing fair discriminations among insureds. Framing the definition of such a fairness in a comparative perspective notably focusing on the comparison of the principles applicable in Europe and Türkiye, the seminar was devoted to the analysis of the anti-discriminatory provisions entrenched in the Principles of European Insurance Contract Law (PEICL), reiterating the European anti-discriminatory law on gender, nationality or race.

Reinsurance and Catastrophic Losses

Prof. Merkin QC delivered a three-hour certificate program to undergraduate and postgraduate law students on the basics of reinsurance law and why reinsurance is an important risk management tool particularly in respect of natural disasters. He gave examples from New Zealand Christchurch earthquakes and pointed out what types of legal dispute they gave rise to in the reinsurance context.