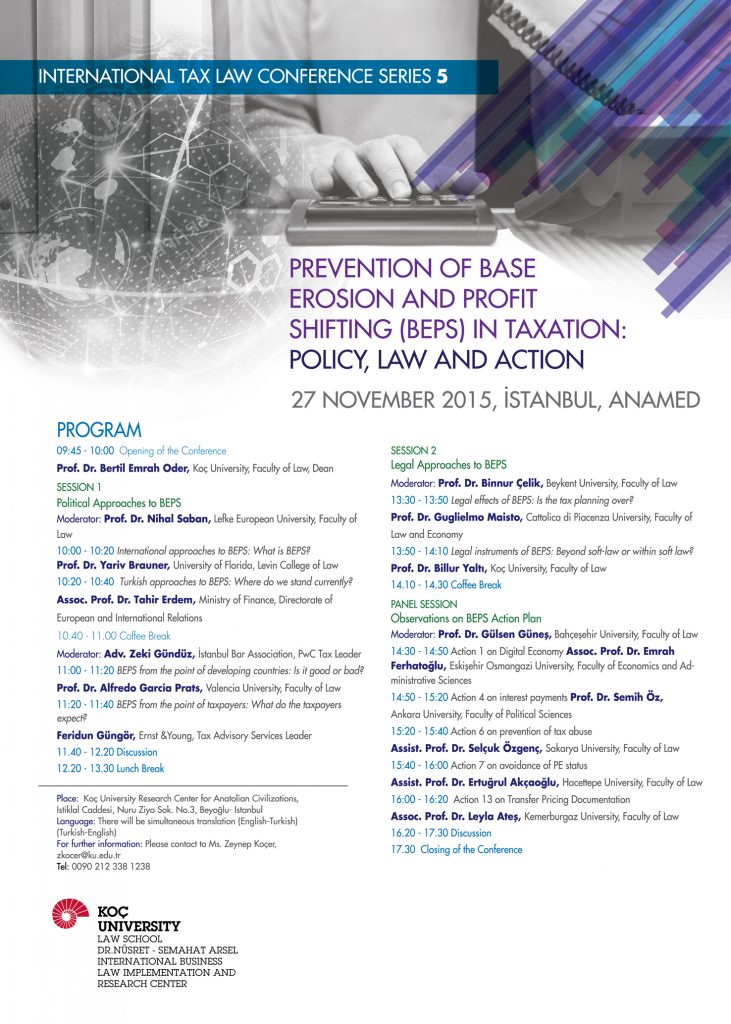

International Tax Law Conference- International Tax Law Conference Series 5- Prevention of Base Erosion and Profit Shifting (BEPS) in Taxation: Policy, Law and Action

Speakers: Prof. Dr. Yariv Brauner, Assoc. Prof. Dr. Tahir Erdem, Prof. Dr. Guglielmo Maisto, Prof. Dr. Billur Yaltı, Assoc. Prof. Dr. Emrah Ferhatoğlu, Prof. Dr. Semih Öz, Assist. Prof. Dr. Selçuk Özgenç, Assist. Prof. Dr. Ertuğrul Akçaoğlu, Assoc. Prof. Dr. Leyla Ateş, Prof. Dr. Nihal Saba, Zeki Gündüz, Prof. Dr. Binnur Çelik, Prof. Dr. Gülsen Güneş.

Conference Content: The Conference focused on the recent initiatives of the OECD on the base erosion and profit shifting by multinationals. During the conference, political and legal aspects and consequences of the OECD BEPS Action Plan and related items of the 15 OCED action reports were discussed. Accordingly, the sub sessions focused on various aspects of the Plan such as, the meaning of BEPS, Turkish, developing country and taxpayer approaches to BEPS, the legal effects and legal sources of BEPS. Finally, the actions on digital economy, interest payments, prevention of tax abuse, avoidance of PE status, and transfer pricing documentation were evaluated. After the illuminating presentations of various internationally and domestically known academics and practitioners, the participants of the conference (150) also contributed valuable insights on the conference topics.

Papers presented in the conference were later published as a book in 2018.